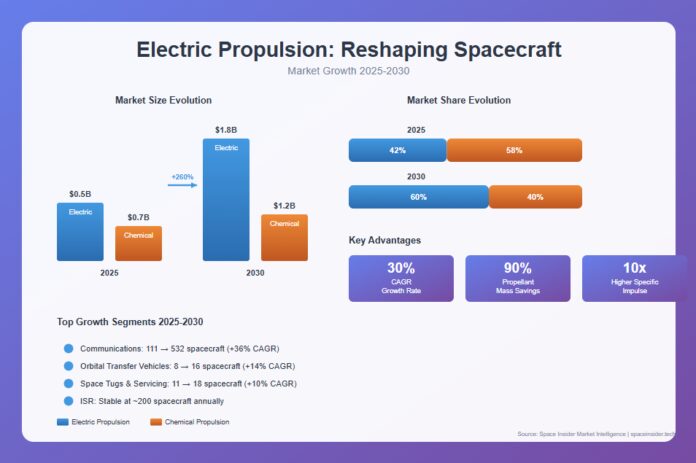

Electric propulsion has moved from a specialized technology to the dominant force in spacecraft design. This isn’t just about technical advancement—it’s about a fundamental shift in how spacecraft are built, operated, and regulated. The numbers tell a compelling story: the electric propulsion market is projected to grow from $0.5B in 2025 to $1.8B in 2030, representing a 30% compound annual growth rate. More significantly, electric propulsion will capture nearly 60% of the in-space propulsion market by 2030, up from 42% today.

This analysis draws on comprehensive data from military, civil, and commercial spacecraft globally, with specific exclusions: vehicles under 100 kg, mega-constellations like SpaceX and OneWeb, and assets tied to China, Russia, North Korea, or Iran. Within this scope, new entrants like Rivada, PWSA Project Convergence, and IRIS² are included. The forecasts combine over a decade of historical data with projections through 2030.

The Acceleration of Electric Propulsion

The momentum is undeniable. Electric propulsion is not just growing—it’s overtaking chemical systems across most orbital functions. This transition is driven by both increasing spacecraft numbers and a fundamental architectural shift. Operators are designing entire constellations around electric propulsion systems that optimize tank size, reduce propellant mass, and increasingly replace chemical engines in mission-critical functions.

What makes this particularly noteworthy is the willingness of operators to accept longer timelines to orbit in exchange for massive efficiency gains. This represents a strategic recalibration in the industry—time to orbit, once considered non-negotiable, is now viewed as an acceptable trade-off when the mass savings and cost efficiency compound across large fleets.

Key Drivers Behind the Shift

Several factors are converging to accelerate electric propulsion adoption:

Orbit Raising Revolution

Electric propulsion now supports full orbit raising across LEO, MEO, and GEO missions, especially for constellations. While the process takes longer than chemical propulsion, operators have fundamentally recalibrated their mission timelines. The mass savings and cost efficiency simply outweigh the extended time to operational orbit.

Precision Orbital Control

Electric propulsion enables precise, continuous thrust for stationkeeping and planned collision avoidance maneuvers. While chemical engines still dominate rapid-response military scenarios, electric systems are sufficient for most commercial applications where events are predictable and can be scheduled.

Regulatory Compliance

Perhaps the most pressing driver is the wave of new regulations. Electric propulsion provides reliable end-of-life solutions, from controlled deorbit in LEO to transfers into GEO graveyard orbits. This has become essential for meeting requirements like the FCC’s 5-year deorbit rule, ITU licensing conditions, and ESA mandates. In an era of increasing orbital congestion, the ability to demonstrate compliant disposal is non-negotiable.

The Economic Imperative

The economic case is staggering. With specific impulse up to ten times higher than chemical systems, electric propulsion can cut propellant requirements by as much as 90%. A GEO satellite that might carry over 2,000 kilograms of chemical propellant can achieve equivalent performance with only a few hundred kilograms of xenon. The difference frees up mass for additional payloads, lowers launch costs, and delivers compounding savings when scaled across large fleets.

| Driver | Explanation | Strategic Benefit |

| Orbit raising | Efficient propulsion for long-duration climbs | Reduces launch mass and cost |

| Stationkeeping | Continuous low-thrust capability | Predictable maneuvering and slot control |

| Collision avoidance | Reliable planned maneuver support | Improved safety and regulatory confidence |

| End-of-life disposal | Supports controlled reentry and graveyard transfers | Meets global sustainability rules |

| Economic efficiency | Very high specific impulse, low propellant mass | Major cost savings across fleets |

Where Chemical Propulsion Still Matters

Electric propulsion is not eliminating chemical systems—it’s redefining their role. Chemical propulsion remains indispensable for high-thrust, time-critical applications. Missions demanding rapid acceleration, such as direct injection into GEO or planetary exploration, continue to rely on large bipropellant modules.

NASA’s Europa Clipper, launched in 2024 with 24 hypergolic engines for Jupiter orbit insertion and trajectory corrections, exemplifies this. Human spaceflight also depends on chemical systems—NASA’s Orion spacecraft carries an Aerojet Rocketdyne AJ10 bipropellant engine for emergency maneuvers where crew safety requires immediate response. Military spacecraft engaged in rapid-response scenarios likewise continue to depend on chemical propulsion.

The result is a rebalancing: electric propulsion is becoming the baseline architecture for future spacecraft, while chemical propulsion is increasingly confined to specialized roles where speed and thrust remain paramount.

Growth by Mission Segment

Electric propulsion adoption varies significantly across mission categories. Understanding these patterns reveals where the technology is becoming standard and where specialized requirements still favor alternative approaches.

High-Growth Segments

Communications: The largest and fastest-growing driver of electric propulsion demand, expanding from 111 spacecraft in 2025 to 532 in 2030 (approximately 36% CAGR). When excluding sovereign-backed constellations such as Rivada, Telesat Lightspeed, and IRIS², growth moderates to approximately 15% CAGR. Even at that rate, electric propulsion is now the standard choice for commercial fleets.

Orbital Transfer Vehicles (OTVs): Doubling from 8 spacecraft in 2025 to 16 in 2030 (approximately 14% CAGR). Electric propulsion underpins their economics by enabling cost-efficient payload repositioning, with operators accepting longer transfer times in exchange for reduced costs.

Space Tugs & In-Orbit Servicing: Expanding from 11 spacecraft in 2025 to 18 in 2030 (approximately 10% CAGR). Electric propulsion makes life-extension, debris removal, and servicing missions viable, where sustained, low-thrust maneuvers are critical.

Steady Demand Segments

Intelligence, Security & Reconnaissance (ISR): Stabilizing near 200 spacecraft annually by 2030, driven by programs such as PWSA’s Transport and Tracking layers. Electric propulsion’s role here is tied to persistent maneuverability, regulatory compliance, and resilience in contested orbital environments.

Earth Observation (EO): Demand dips mid-decade but rebounds to 77 spacecraft by 2030 (up from 30 in 2027). Electric propulsion is increasingly adopted to extend spacecraft lifetimes, improve revisit rates, and ensure compliance in crowded sun-synchronous orbits.

Navigation & Science: A slower-growing segment, inching from 78 spacecraft in 2025 to 80 in 2030. Long satellite lifetimes in MEO limit replacement demand, but electric propulsion adoption continues in science missions where precision and stability are essential.

Specialized Segments

Exploration/Interplanetary Missions: Small in volume but highly visible, fluctuating between 5-18 spacecraft per year. Chemical propulsion remains essential for high-thrust burns, but electric propulsion is increasingly indispensable for efficient cruise phases on Mars, lunar, and deep-space probes.

Human Spaceflight & Station Modules: Stable demand at around 10-14 spacecraft annually. Electric propulsion supports orbital maintenance and logistics, while chemical propulsion continues to dominate contingency maneuvers where crew safety requires immediate response.

| Mission Segment | 2025 Spacecraft | 2030 Spacecraft | Trend |

| Communications | 111 | 532 | Significant growth |

| OTVs | 8 | 16 | Moderate scaling |

| Space tugs & servicing | 11 | 18 | Steady expansion |

| ISR | ~200 | ~200 | Stable |

| Earth Observation | 30 | 77 | Strong rebound |

| Navigation & science | 78 | 80 | Minimal change |

| Exploration | 5-18 | 5-18 | Variable |

| Human spaceflight | 10-14 | 10-14 | Stable |

Strategic Implications

Electric propulsion has evolved from a peripheral technology to strategic infrastructure. The implications vary by stakeholder:

- For governments: Electric propulsion is central to orbital sustainability and resilience, reducing congestion risks and ensuring long-term access to space.

- For operators: It has shifted from an efficiency upgrade to a business imperative, unlocking payload capacity, lowering launch costs, enabling compliance with strict disposal regulations, and extending satellite lifetimes.

- For investors: It represents one of the fastest-scaling opportunities in the space economy, with total demand forecast to nearly triple within five years and electric systems capturing the majority of that growth.

Key Takeaways

What emerges from this analysis is not uniform adoption but a fundamental recalibration of roles. Electric propulsion is scaling where efficiency and compliance drive the business case, while chemical propulsion is retreating to contexts where urgency and thrust are non-negotiable. This is creating a hybrid landscape where electric propulsion defines the baseline and chemical systems provide targeted support.

The spacecraft industry is in the midst of a propulsion transition that will reshape everything from mission design to business models. Understanding these dynamics—where electric propulsion wins, where chemical systems still matter, and how different mission segments are adapting—is essential for anyone operating in or investing in the space economy.

Frequently Asked Questions

What is electric propulsion in simple terms?

Electric propulsion uses electricity to accelerate propellant, allowing spacecraft to maneuver efficiently with far less fuel than chemical systems.

Why is electric propulsion growing so quickly?

It saves mass, reduces costs, increases spacecraft lifetimes, and ensures compliance with tightening orbital regulations.

Will chemical propulsion disappear?

No. Chemical propulsion remains essential wherever missions need immediate or high thrust, such as planetary insertion or human spaceflight contingencies.

Which missions benefit most from electric propulsion?

Communications fleets, orbital transfer vehicles, and in-orbit servicing missions gain the most value because they scale efficiency across large constellations.

Is electric propulsion reliable for end-of-life disposal?

Yes. It is now the preferred method for controlled deorbiting and graveyard transfers under FCC, ITU, and ESA regulations